The Future of Cryptocurrency 2020: Developing Countries and Emerging Economies

As Coinmap recently mentioned, many of the world's major digital currency hubs are located in the relatively crypto-friendly nations that make up Europe, North America, and East Asia. From Silicon Valley to Seoul, the Global North presents plenty of places to spend crypto and nearly as many places working on developing what's next. So it's easy to forget that there are large parts of the world where people are living in the aftermath of disastrous economic mismanagement and where there may be little access to the internet or even conventional financial establishments like banks. But recent local and international shifts have shown that developing countries are charting new crypto futures to "leapfrog" into the 21st century digital economy, proving themselves as emerging markets for Bitcoin and other blockchain-based innovations. So we're here to show you why emerging crypto countries are places that investors, spenders, and anyone interested in virtual currencies should be rooting for—and why Bitcoin is the future especially for the nations of the Indian subcontinent, Africa, and the Middle East.

The global economic divide: why we should care and why crypto matters

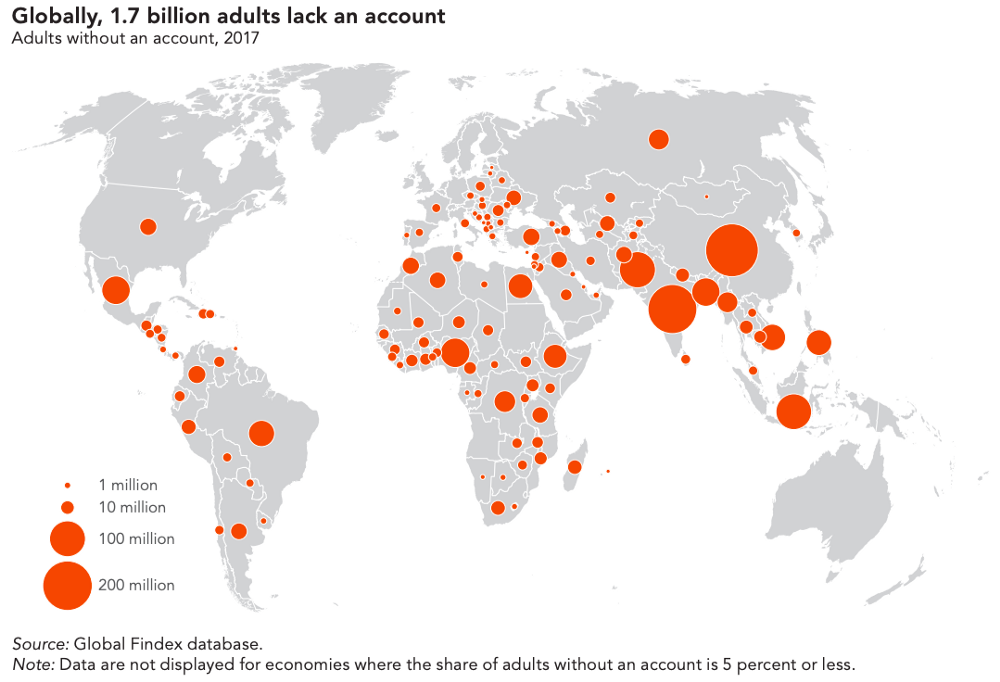

Many of our readers come from the US and Europe where it's easy, especially in times like the acute COVID-induced global recession, to overlook the chronic economic suffering that many see only on the news or in documentaries. The West writ large also has accessible and relatively stable banking and finance sectors even in times of crisis, meaning crypto can easily be seen simply as a new investing tool or an alternative to be perfected in the future. But Zimbabwe's bouts of hyperinflation, India's overnight demonetization of banknotes, and the collapse of traditional government and finance structures across the Middle East are just a few examples of how a revolution in money can be more than just an investment proposition or a pie-in-the sky idea: cryptocurrency may be a literal lifeline for billions.

What's more, today's increasingly globalized economy requires the transfer of goods, services, and people across many different borders, meaning that a well-functioning monetary system is a concern that is both international and local. To function smoothly, people need to be able to use money and keep records easily, no matter if you're in New York or Nigeria. By strengthening buying and trading in one part of the globe, the entire world economy can be made more robust and more resilient, and the crypto economy in particular can see expanded use cases and greater demand.

But it's only by getting as many users as possible to participate that a new era of global capital can be built on blockchain technologies. Luckily, countless people in the areas below are beginning to test one of crypto's trickier use cases—a medium of exchange—on large scales, sometimes even as a primary currency for everyday purchases.

Crypto in India

India and Bitcoin have a strange history dating back to the birth of cryptocurrencies. With the country's massive population, millions of whom are unbanked, and large population of technologically literate workers, India seemed at first to be a natural haven for crypto users. This sentiment was only strengthened in 2016 after the Indian government revoked nearly 86% of banknotes literally overnight, causing a run on banks, a 2% contraction in economic activity, general chaos, and a questioning of national monetary policy. That promise, however, was dashed in 2018 when the Indian central bank banned all crypto transactions, and then was renewed again in March 2020 when an appeals process finally made crypto legal in India.

In the month following the decision, trades on the largest cryptocurrency exchange in India exploded by nearly 500%, pushing millions of dollars and hundreds of thousands of new users into the crypto ecosystem. Some see the government's more liberal stance as an avenue to further legitimize Bitcoin as an international asset class, add much-needed growth to the state budget, and increase the use of digital payments among the general public—which, ironically, was one goal of the 2016 banknote fiasco. Furthermore, allowing crypto to come into the open means a new business opportunity for development jobs and innovation in cities like Bengaluru, the heart of the huge Indian tech industry.

Crypto in Africa

Even as the continent struggles at the moment, Africa's developing economies have long been seen as the future for markets—meaning money and crypto are unavoidably part of the conversation. The issues holding back the African economy are many and complex, with unstable, corrupt governments and widespread unemployment foremost among them. Government incompetence, for example, was the direct cause of the hyperinflation crises of the last three decades in Zimbabwe, when inflation rates sometimes reached in the hundreds of percentage points. And some international businesses are at least partially discouraged from expanding to African countries due to currency difficulties—one person described having to go through at least four different banks to make a simple transfer from an African bank account to a European organization, racking up over 10% of the payment in fees along the way.

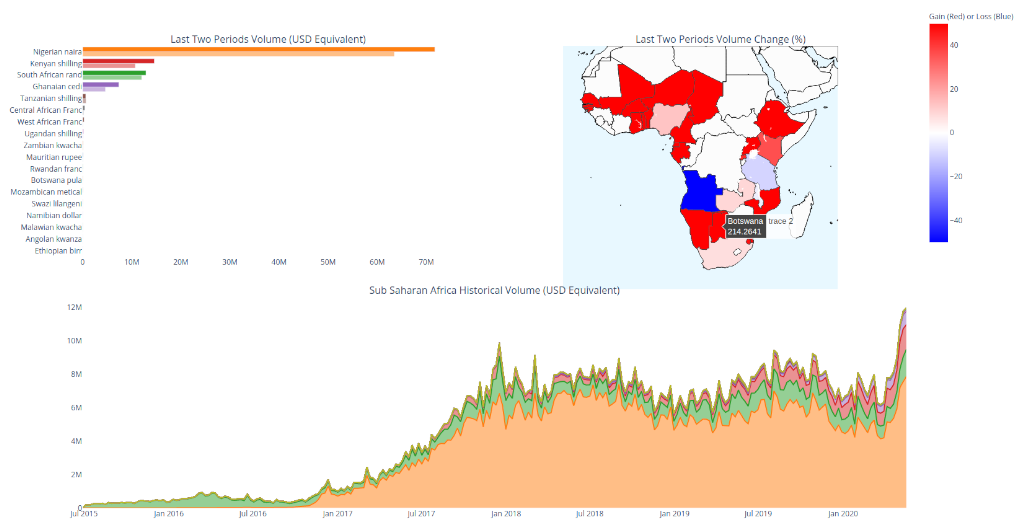

For these reasons and many more, many African citizens have begun going around fiat currencies and tightly controlled processes altogether. Rich and poor alike have turned to mobile banking, for example, to cut out the need for cash. This provides a familiar stage for the African crypto scene to adopt cash-like alternatives, from the original Bitcoin to Litecoin to Bitcoin Cash, for use in everyday transactions. Furthermore, stablecoins balanced by one or more international currencies and trade-simplifying tokens like Ripple's XRP could break down conversion barriers that prevent corporations and entrepreneurs from wanting to do business in Africa. And for those Africans who still lack consistent internet access or aren't ready to commit to fully digital transactions, using cash to buy bitcoin locally is only getting easier.

There is still plenty of work to be done before virtual currencies are the norm in Africa, but all the ingredients for change are there, namely large, youthful populations with major reasons to switch over to crypto. As if more proof was needed for the continent's promise, spring 2020 brought record trade volumes on African peer-to-peer crypto markets even amid coronavirus panics and the leadup to the Bitcoin Halving.

Crypto in the Middle East

Many international observers have watched in horror or helplessness over the last decades as the Middle East has been rocked by invasions, revolutions, extremism, and refugee crises. These factors have resulted from or led to weak governments, dislocated peoples, and struggles for basic human rights—naturally including the right to economic security. Though a monetary revolution is unlikely to solve all or even any of the region's problems, blockchain-based innovations could be a silver lining to the Middle East's turmoil—and could provide an example to the wider global economy.

Take Lebanon as one of the most recent examples. Last year the local government curbed bank withdrawals and even closed banks, partially contributing to nationwide antigovernment protests. To circumvent capital controls and preserve as much of their wealth as possible, many Lebanese people have turned to Bitcoin to get their money out of the country—or at least out of authoritarian hands. Next door in Syria, activists like Amir Taaki are opening the country and its people to the outside world through the use of open-source fintech. Even a fledgling state in the region, Rojava, is using blockchain technology to gain monetary independence and establish a secular, highly democratic governing apparatus.

As with many things in the Middle East, times are changing quickly and it remains to be seen if these and other crypto-based innovations will take root. The hope is, though, that these networks can bring marginalized peoples stability and inclusion in a world that has often written them off.

These are just some of the most notable regions in the world where crypto has a lot to offer. By broadening the number of users who are familiar with digital currencies and related technologies, it's possible to bring the world together just a bit more. Our sister site, Invity.io, also aims to make it easy to join the world of crypto: you can use the Buy crypto feature to purchase bitcoin and altcoins using US dollars, euros, Indian rupees, Nigerian nairas, and more from anywhere in the world in just a few clicks. Or use Coinmap to explore what's in your corner of the crypto world—there's more out there than you may think!

Cover photo: African woman 1o by TLC Jonhson, public domain under CC0 1.0.

Coinmap gives you the best places in the world to spend cryptocurrencies. But before you spend crypto, you have to get some: our companion project Invity.io gives you the best all-in-one place to buy, exchange, and save digital currencies.