Crypto in Brazil: A Hands-Off Approach and High Crypto Ownership

Bolstered by a strong financial tech sector and a lax approach to governing said sector, Brazil is an extremely popular destination for both crypto holders and cryptocurrency businesses. This deep dive will explore the country’s socioeconomic context, the state of crypto in Brazil, and where we might see its crypto industry take off from here.

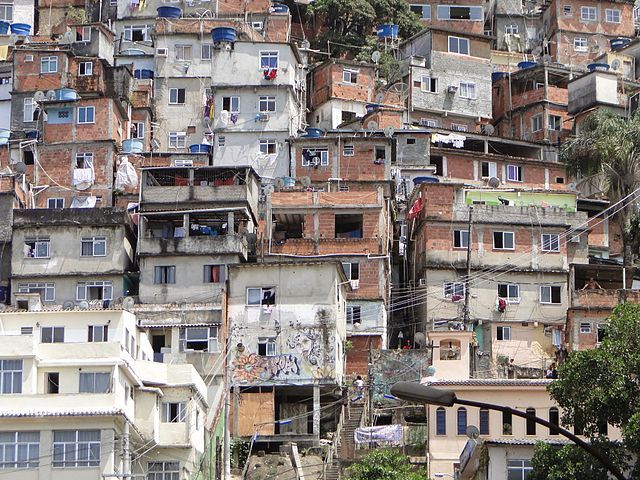

Brazil is home to significant economic inequality

Brazil is one of the largest economies in South America. Yet, despite the nation’s wealth, it is also one of the world’s most financially unequal. According to Oxfam, Brazil has made strides over recent years to reduce inequality and raise the base of its social pyramid. Still, a significant divide separates the country’s wealthy and its everyday citizens.

The nation’s progress away from this inequality has been threatened by circumstances such as the ongoing COVID-19 pandemic. According to Americas Quarterly, Brazil's poor saw a 40% reduction in earnings during 2020 while the wealthiest 10% lost just 3% of their income over the same period of time. Further, while many people in Brazil were actively suffering from poverty, the nation’s stock market soared to record highs.

When it comes to the country’s financial technology industry, organizations like the International Trade Administration (ITA) note Brazil as having one of the world’s largest fintech markets. According to the ITA, the country has the largest fintech sector in Latin America and the fifth largest in the world. As of the ITA's 2021 report, around 700 startup companies comprised Brazil’s fintech landscape.

As outlined by Thomson Reuters, the Brazilian financial sector is home to regulations that govern industry behaviors, foreign investment requirements, liquidation rules, and sets a wealth of other rules which banks and other financial entities are penalized for breaking. By contrast, however, Brazil’s financial technology sector has largely skirted these rules and is instead treated with a more hands-off approach. This continues to be a point of contention for some stakeholders, with Reuters reporting that traditional banks have accused the fintech sector of receiving special treatment and have attempted to pressure the government into preparing new regulations.

The state of crypto in Brazil

Brazil’s relaxed approach to financial technology has largely extended to crypto. Aside from the nation’s crypto tax laws, which came into place in 2019 and mandate that people whose crypto holdings exceed R$5000 (around $900 USD as of press time) report it on their tax return, Brazilian regulators have largely let crypto develop on its own.

Back in March, the country became the second in the Americas to approve a bitcoin exchange-traded fund (ETF). In addition, in the first quarter of 2021 alone, the 2.7 million users of the country’s largest bitcoin exchange reportedly accounted for nearly $5 billion in crypto trades. This, Coindesk reported, meant that more crypto was traded on the platform in one quarter than in the seven years prior; in 2020, for example, Brazilians it traded a comparatively low $1.2 billion.

Unlike some other major players like China, Brazil is yet to make any substantial effort to negatively impact the cryptocurrency movement. This, coupled with the nation’s thriving financial technology sector, seems to make it a popular destination for crypto businesses. Using Coinmap’s interactive ATM and merchant tracker, we can see dozens of crypto hotspots throughout the country.

flickThe popularity of crypto businesses in Brazil is further corroborated by Statista, which found that Brazil is home to more than 15 major cities that either have crypto ATMs or stores that allow cryptocurrencies like Bitcoin to be used as a payment method. This includes São Paulo, a city with a massive financial sector that, as of March 20201, was reportedly home to 358 merchants who accept crypto.

According to CoinDesk, Brazil’s central bank acknowledged that Brazilians held somewhere in the ballpark of $50 billion USD worth of digital assets as of mid-October. By contrast, Brazilians hold an estimated $16 billion worth of U.S. stocks.

In fact, a report published in 2019 found that Brazilians were among the world’s largest holders of cryptocurrencies, with just shy of 5% of the population owning at least one crypto. Notably, by poring over these findings, Electroneum discovered that 40% of those holding crypto in Brazil at the time were earning less than the country’s minimum wage.

Overall, the everyday popularity of crypto in Brazil does not seem to show any immediate signs of slowing down. A report by Crypto Literacy published on November 1 found that 30% of Brazilian respondents were likely to buy or sell crypto in the next six months. By contrast, only 12% of people from the United States gave the same response. In addition, 25% of Brazilians said they would use crypto to pay for goods and services.

The sum of these findings depict Brazil as an extremely popular place to hold, trade, and even spend cryptocurrencies—even among those most impacted by the country’s wealth inequality. But as cryptocurrency regulation around the world continues to develop, is Brazil likely to remain a destination of choice for crypto businesses and traders?

What does the future hold for crypto in Brazil?

Brazil is among the biggest crypto stakeholders in South America, and crypto has largely thrived in the country on the foundation of the relaxed approach taken by its regulators. By contrast, in Central America, El Salvador has caught a lot of attention for using regulation and mandates to introduce crypto adoption to its citizens. As part of this process, El Salvador became the first country in the world to recognize Bitcoin as legal tender.

Amid the spectacle created by El Salvador recognizing Bitcoin as an official currency, there was widely-reported speculation that Brazil would soon take a similar approach. However, this appears to not be the case, with reporting from Nasdaq stressing that Brazil is not following El Salvador's lead.

Instead, Brazil appears to be considering less radical regulations of its own—though it is worth noting that this promise has gone undelivered by the country’s lawmakers in the past. Over the last couple of months, we’ve seen reports that the country is working to tighten its anti-money laundering (AML) requirements in a move claimed to curb the use of crypto for illegal activities. Currently, it does not seem like these regulations are targeting legitimate cryptocurrency transactions, which represent the overwhelming majority of crypto activities today.

Details of any new regulatory action are few and far between, with little in the way of updates outside of knowing that developing new regulation is on the agenda. While the idea that Brazilian regulators would fully embrace cryptocurrencies like Bitcoin in the same way as El Salvador appears unfounded, so too does the idea that they will try to harshly crack down on their popularity. Ultimately, only time will tell how new regulation—if delivered—will impact crypto businesses and traders in Brazil. If handled correctly, it’s certainly possible that it could cement, rather than diminish, the country’s status as a major stakeholder in the crypto conversation.

To get started buying crypto with Brazilian reals, dollars, euros, or other major currencies, check out our sister site Invity.io, where you can buy, exchange, and sell crypto easily and instantly.