The State of Crypto in the United States in 2021

No matter where in the world you live, the top stories in the United States usually make the news where you live too. For the past month it's been the aftermath of the 2020 election, for the past five years it's been the antics of Donald Trump, for the past two decades it's been the creation an aggressive worldwide security regime under the guise of antiterrorism, and for much longer than that it's been how the world's largest economy is affecting activities around the world. While these topics are undeniably interconnected to begin with, looking at them through the lens of Bitcoin and cryptocurrencies makes them completely inseparable. It should be noted that the United States is a massive and many-armed power and that each of its 50 states has different and often conflicting attitudes towards cryptocurrencies—meaning a complete analysis of the current state of digital currencies in the US would require a book or more. But if you've been asking yourself questions like "What does the election of Joe Biden mean for crypto?", "What does Janet Yellen think of Bitcoin?", or "Will Bitcoin ever see mass adoption?", this latest entry on our crypto world tour should give you an idea of the United States' relationship with crypto and what to look for in the coming year.

Opportunities and Pitfalls of the World's Largest Economy

The current status of cryptocurrencies in the US can only truly be appreciated in the context of the American relationship with currency. Around the start of the 20th century, the US had become the world's largest economy by many metrics, and this leading role was cemented by the end of World War II by the Bretton Woods agreement. This made the US dollar the world's reserve currency, at first backed by gold and eventually decoupled from the gold standard. In short, this unique status has meant that for over 75 years the US dollar has been how countries keep track of their debts, how banks tabulate their reserves in an international context, and how global trade is carried out efficiently. More darkly, this dominant position has meant that the US can set and enforce crushing and sometime arbitrary economic to cut enemies out of the global economy—check out Coinmap's examination of crypto in Iran for more. The dollar as the world's reserve currency has also meant that political changes and economic events in the United States can and do have major impacts on the entire world's economy.

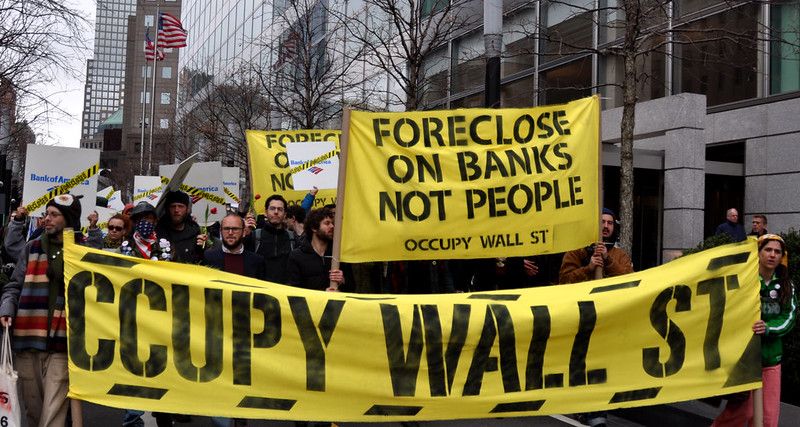

These historical features helped the US economy grow throughout the 20th century as investments flowed in and US strengths moved from manufacturing to more complex financial products. However, the free ride was not without its bumps, with one of the most recent and the most closely related to digital currencies being the 2008 financial crisis. Through decades of mismanagement and greed by business executives and politicians, a number of banks—most based in the US—were ready to collapse. Yet due in part to the role of the dollar as the world's reserve currency, these banks were deemed too big to fail: to save the world's economy from another great depression, these banks were bailed out with money printed out of thin air and their executives were given a slap on the wrist at most. It's these events that directly inspired the Satoshi Nakamoto to release the Bitcoin whitepaper as a proposal for how to take the control of global finance out of the hands of unaccountable elites and to let anyone be their own bank.

So what we can take from this (very) brief history of currency in the US is, first and foremost, that the United States appreciates its leadership role in all aspects of world affairs due to the size of its economy and the fact that most other economies rely on the US dollar to function. Second, it would be against US interests to give up this role and to transition to a more decentralized monetary system. Third, US businesses and politics are very closely intertwined and regulations (or at least their consequences) related to the flow of money are lax.

The schizophrenic recent past: current crypto regulations

The Obama era

So it's not surprising that the current state of crypto in the US is contradictory, at least when it comes to those making the rules that US consumers and companies have to follow when it comes to using crypto. The Obama administration came into power in the immediate aftermath of the financial crisis and the infancy of digital currencies and promised more rigorous regulation of banking practices. However, it was initially slow to recognize crypto specifically and it is difficult to determine what if any detailed views the former president held or holds. During these years the IRS did make its first crypto tax regulations for US citizens, which classified Bitcoin as property, similar to stocks or real estate. This status, and its related detailed record keeping and reporting requirements, is arguably a major part of what has hindered the wider adoption of cryptocurrencies as a medium of exchange—in other words, these regulations have kept crypto primarily as a store of value.

It also came to light that crypto-related businesses were included in Operation Choke Point, which discouraged banks from doing business with "what [the Obama administration] considers questionable financial ventures." Obama himself also, in the later years of his tenure, comment on the security implications of decentralized, encrypted currencies, playing up the erroneous view that crypto is primarily used by criminals, terrorists, and other unsavory types. So it's fair to say that when Bitcoin wasn't ignored by crypto, US actions were unfriendly to this potential revolution in money.

The Trump era

Basic awareness of crypto continued to grow during the Trump administration which, among its many controversial views, also made deregulation a focus in all of its policy areas. It would seem, then, that this would indicate a friendlier stance toward crypto and the largely anti-authoritarian crypto community. In some respects this has proved true: the IRS clarified but didn't significantly add to its crypto guidelines, Operation Choke Point was formally terminated, and the Office of the Comptroller of the Currency has allowed crypto banks like Kraken to begin operating.

However, the "America first" administration is also very conscious of both the dollar's central global role and perceived threats to the physical and economic well-being of the US. According to former National Security Advisor John Bolton, Trump directed Secretary of the Treasury Steven Mnuchin to "go after Bitcoin" even as the president himself seems to believe that crypto's value is based on nothing but thin air. To this end, there have been rumors in recent days that Mnuchin may roll out additional crypto regulations before transitioning to the Biden administration. Among these regulations are expected to be tighter identity and reporting requirements for Americans using crypto wallets. In some ways, regulations are simply part of the mortifying experience of crypto being known; on the other hand, these possible new developments seem hypocritical and unexpected from an administration touting economic achievements and deregulation.

Uncertainty and gerontocracy: Is Biden equipped to deal with crypto?

I don’t have Bitcoin, and I’ll never ask you to send me any.

— Joe Biden (@JoeBiden) July 16, 2020

But if you want to chip in to help make Donald Trump a one-term President, you can do that here: https://t.co/8XtBjuU5fX

But it's not yet known if these new regulations will even come to pass in the lame duck period of the Trump presidency, and unfortunately the new administration seems similarly opaque. While Joe Biden was a target of the major Bitcoin-related Twitter hack earlier in 2020, the incoming president has no known position on crypto other than saying he doesn't own any. More telling is his pick for Treasury Secretary, Janet Yellen. As a former chair of the Federal Reserve, she has strong views on currencies of all types. She has said outright that she is "not a fan" of cryptocurrencies, believing them to be unstable sources of value, potentially illegal, and needlessly energy consumptive (despite all of these having been debunked). When combined with the knowledge of how past Democratic administrations have attempted to deal with economic crises, this makes it seem that some attempt to put financial tools under greater government control is likely. Confusingly, however, Yellen has also suggested the the US government may have no authority to regulate Bitcoin and that blockchain-based systems hold promise for banking, which seems to be a very fine hair to split.

The president-elect's confused take on crypto continues in Biden's current orbit of advisors, which includes Gary Gensler, a banker-turned-regulator who teaches blockchain courses at MIT, and Andrew Yang, a tech advocate and noted crypto proponent. Meanwhile, the House of Representatives remains in Democratic hands but is led by a coterie of politicians in their 70s and 80s. Given the difficulty many of these figures have shown in hearings attempting to regulate social media giants like Facebook and Google, it's hard to believe that these leaders would have crypto on their radar, much less an advanced grasp of how it works or how regulations may impact this field. It's still unknown which party will control the US Senate; if the Democrats take control, the same problem of limited understanding will rear its head, and if Republicans retain control it's likely that no major, permanent regulations of any sort will be passed.

So in the end, the future of Bitcoin in 2021 seems as unpredictable as the year 2020 has been. What we can conclude is that US politics and currency concerns are inseparable, with massive implications for the global economy. For now, however, the current state of affairs is highly patchwork and new regulations would likely be annoying but not crippling—if they emerge at all. But two things are certain even now: the number of places accepting crypto is only growing, and buying crypto is one of the best ways to work toward a future without borders.

Cover photo: Businessmen standing beside bitcoin on a rock and USA flag in the background by Jernej Furman, licensed under CC BY 2.0.

Coinmap gives you the best places in the world to spend cryptocurrencies. But before you spend crypto, you have to get some: our companion project Invity.io gives you the best all-in-one place to buy, exchange, and save digital currencies.